Social Impact Token (SI Token)

Warning

Currently, only Social Impact Prototype Token (SIP Token) exists. See SIP Token

Social Impact Token (SI Token) is used for payment flows (including investment, money allocation, interest rate and payouts).

SI Token is an ERC20 token on the Ethereum Blockchain, programmed in Solidity.

All interactions with SI Token can be done through SI platform (frontend).

Since the token was implemented according to the ERC20 standard, the basic functions (e.g. sending and receiving) can also be performed via any ERC20-enabled wallet.

Social Impact Prototype Token (SIP Token)

Social Impact Network is currently in the prototype phase. In order to test Social Impact Network and its Transparent Impact Measurement System, Social Impact Prototype Token has been developed.

In contrast to SI Token, some simplified conditions were created for SIP Token. These conditions were created in order to reduce the regulatory aspects of the security token to a minimum.

Simplified conditions

The underlying security is not publicly offered.

Investors and project beneficiaries are limited and known to SI Network. No external parties are involved.

The aid organization and the beneficiary are identical and will be a natural person within UNDP Lebanon.

Proceeds from token sales will be received directly through Smart Contract in ETH or DAI. No external financial service provider will be involved.

The token value is pegged at $1 (1 SIP = $1). There will be no calculation of Asset Net value.

It is a single project funding and no other projects will be funded through this token.

The project duration is limited to 6 months.

Interest and principal payments are transferred monthly.

Interest and payouts will be distributed to investors’ via DAI tokens. All payouts have to be be initiated by the investor through SI platform.

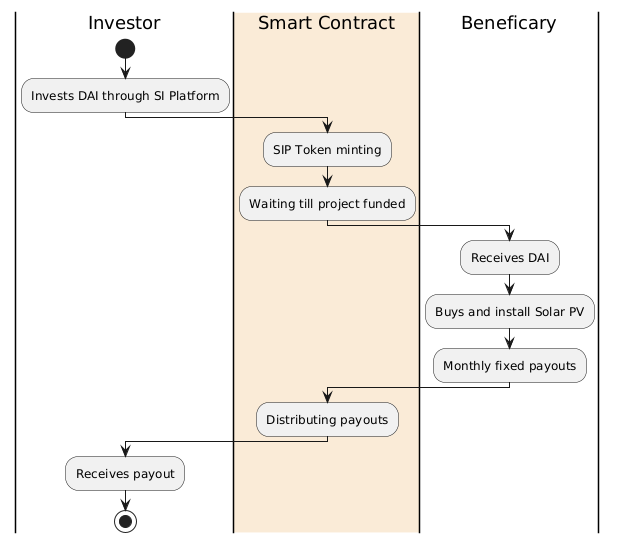

Investment and payout process (SIP Token)

Note

SIP token is a payout token. Monthly interest and dividend payments are transferred to investors in DAI via token. Withdrawals can be initiated at any time via SI platform.

The (known) investors invests via SI platform (frontend) and pays in DAI or Ether.

SIP tokens are generated (minted) by the smart contract and transferred to investor.

The investor’s funds are then transferred (along with the funds of the other known investors) to the project beneficiary.

The project beneficiary, together with a contractor, builds a solar system for himself.

The beneficiary pays monthly interest and payouts directly to the smart contract in DAI.

DAI is credited to investors on proportional basis.

Investors can withdraw their credited DAI at any time.

Smart Contract

The basic functionalities of SIP’s smart contract are the same as those of SIP token.

Due to the mentioned simplification, the methods for calculating NetAssetValue have been removed.

Due to the simplification, SIP token is limited to a single project .

Due to the removal of the fiat payment channels, however, two methods for additional payment processes needed to be included in the smart contract:

Main Methods

Method |

Description |

|---|

Buy |

Through the buy method, the known investor can buy SIP tokens using Ether or DAI. This functionality is represented in SI token through a licensed financial partner and preceding KYC processes. |

Claim (Beneficary) |

The beneficiary is able to withdraw investors’ DAI, which will be used to pay for the solar panel installation |

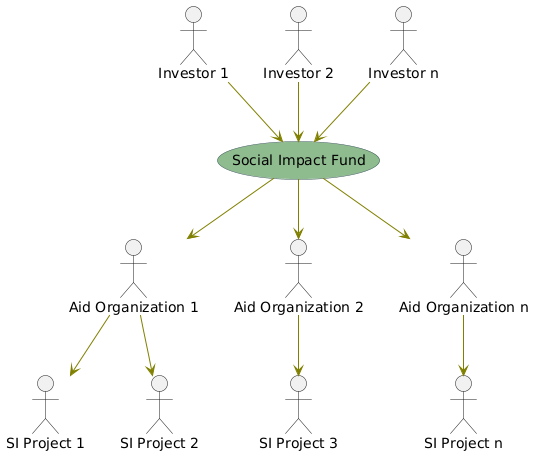

Vision Social Impact Token

The basic concept of the SI Network Funding mechanism is that the investor invests in a funding pool. For his investment in this pool, the investor receives SI Tokens according to the token price and the investment amount.

The token price is calculated according to Asset Net Value and reflects the real performance of the projects.

The funds of the funding pool are used by the authorized aid organizations to implement planned sustainable projects with a defined ROI (on average >6%).

All SI projects generate revenue and distribute them to investors.

A list of planned projects can be viewed on the SI platform (front end).

Dividends from the investment projects are distributed to the investors in DAI or Fiat (e.g. Eur, USD) at regular intervals (usually monthly).

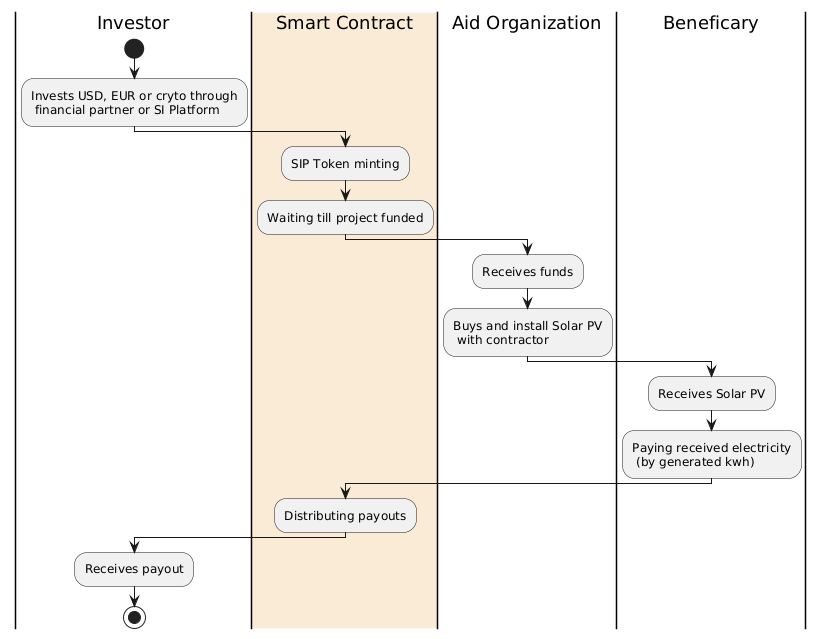

Investment and payout process (SI Token)

Warning

To learn about Social Impact Prototype Token (SIP Token) investment and payout process, please click here.

Note

SI token is a payout token. Monthly interest and dividend payments are transferred to investors in DAI via token. Withdrawals can be initiated at any time via SI platform.

Warning

Currently, SI Network only funds solar projects

Investor purchases SI tokens through a licensed partner or through SI platform.

SI tokens are created (minted) for the investor and sent to him.

Investor’s funds (along with other investors’ funds) are sent to aid organization.

Aid organization and contractor build together a solar system for a specified beneficiary.

Beneficiary pays the received energy to the aid organization.

Aid organization exchanges the payment in DAI.

DAI goes directly into the smart contract.

DAI is distributed proportionately to all investors; parts of payments are kept (reinvested) for future projects.

Social Impact Token (SI Token)¶

Warning

Currently, only Social Impact Prototype Token (SIP Token) exists. See SIP Token

Social Impact Token (SI Token) is used for payment flows (including investment, money allocation, interest rate and payouts). SI Token is an ERC20 token on the Ethereum Blockchain, programmed in Solidity. All interactions with SI Token can be done through SI platform (frontend). Since the token was implemented according to the ERC20 standard, the basic functions (e.g. sending and receiving) can also be performed via any ERC20-enabled wallet.

Social Impact Prototype Token (SIP Token)¶

Social Impact Network is currently in the prototype phase. In order to test Social Impact Network and its Transparent Impact Measurement System, Social Impact Prototype Token has been developed.

In contrast to SI Token, some simplified conditions were created for SIP Token. These conditions were created in order to reduce the regulatory aspects of the security token to a minimum.

Simplified conditions¶

The underlying security is not publicly offered.

Investors and project beneficiaries are limited and known to SI Network. No external parties are involved.

The aid organization and the beneficiary are identical and will be a natural person within UNDP Lebanon.

Proceeds from token sales will be received directly through Smart Contract in ETH or DAI. No external financial service provider will be involved.

The token value is pegged at $1 (1 SIP = $1). There will be no calculation of Asset Net value.

It is a single project funding and no other projects will be funded through this token.

The project duration is limited to 6 months.

Interest and principal payments are transferred monthly.

Interest and payouts will be distributed to investors’ via DAI tokens. All payouts have to be be initiated by the investor through SI platform.

Investment and payout process (SIP Token)¶

Note

SIP token is a payout token. Monthly interest and dividend payments are transferred to investors in DAI via token. Withdrawals can be initiated at any time via SI platform.

The (known) investors invests via SI platform (frontend) and pays in DAI or Ether.

SIP tokens are generated (minted) by the smart contract and transferred to investor.

The investor’s funds are then transferred (along with the funds of the other known investors) to the project beneficiary.

The project beneficiary, together with a contractor, builds a solar system for himself.

The beneficiary pays monthly interest and payouts directly to the smart contract in DAI.

DAI is credited to investors on proportional basis.

Investors can withdraw their credited DAI at any time.

Smart Contract¶

The basic functionalities of SIP’s smart contract are the same as those of SIP token. Due to the mentioned simplification, the methods for calculating NetAssetValue have been removed. Due to the simplification, SIP token is limited to a single project . Due to the removal of the fiat payment channels, however, two methods for additional payment processes needed to be included in the smart contract:

Method

Description

Buy

Through the buy method, the known investor can buy SIP tokens using Ether or DAI. This functionality is represented in SI token through a licensed financial partner and preceding KYC processes.

Claim (Beneficary)

The beneficiary is able to withdraw investors’ DAI, which will be used to pay for the solar panel installation

Vision Social Impact Token¶

The basic concept of the SI Network Funding mechanism is that the investor invests in a funding pool. For his investment in this pool, the investor receives SI Tokens according to the token price and the investment amount. The token price is calculated according to Asset Net Value and reflects the real performance of the projects. The funds of the funding pool are used by the authorized aid organizations to implement planned sustainable projects with a defined ROI (on average >6%). All SI projects generate revenue and distribute them to investors. A list of planned projects can be viewed on the SI platform (front end). Dividends from the investment projects are distributed to the investors in DAI or Fiat (e.g. Eur, USD) at regular intervals (usually monthly).

Investment and payout process (SI Token)¶

Warning

To learn about Social Impact Prototype Token (SIP Token) investment and payout process, please click here.

Note

SI token is a payout token. Monthly interest and dividend payments are transferred to investors in DAI via token. Withdrawals can be initiated at any time via SI platform.

Warning

Currently, SI Network only funds solar projects

Investor purchases SI tokens through a licensed partner or through SI platform.

SI tokens are created (minted) for the investor and sent to him.

Investor’s funds (along with other investors’ funds) are sent to aid organization.

Aid organization and contractor build together a solar system for a specified beneficiary.

Beneficiary pays the received energy to the aid organization.

Aid organization exchanges the payment in DAI.

DAI goes directly into the smart contract.

DAI is distributed proportionately to all investors; parts of payments are kept (reinvested) for future projects.